Partner spotlight

HMX.ai partnership evolves to meet transparency needs of governments

Microsoft partner HMX.ai is a relatively small company—but, by using its decades of experience in AI, it is having an outsized impact in the field of global governmental transparency.

“As a small company, we tend to have passions and beliefs about the technology that we bring to the table,” says Kim Mayyasi, CEO of HMX.ai. “After 30 years of working in artificial intelligence, we’ve learned that AI works best when it partners human and machine intelligence. We have a saying that ‘human knowledge plus machine learning works better than either alone.’”

Microsoft ACTS, our Advanced Cloud Transparency Services initiative, and HMX.ai share a strong vision to help utilize technology to solve tax and other transparency issues facing global governments today.

To that end, ACTS and HMX.ai have created a proof of concept for a tax and revenue solution for interested governments, now being deployed in the Middle East and Africa region.

“Tax ministries want to ensure a more just, inclusive, and sustainable system of tax collection,” says Michael Barnett, co-founder and executive vice president of cognitive engineering, HMX.ai. Governments are committed to ensuring transparency in tax revenue collections and in how audits are applied. “The side benefit,” Barnett says, “is recovering additional revenue that might have otherwise been lost while ensuring fairness to all participants.”

Pictured above: Michael Barnett handles technology and project implementation for HMX.ai.

Uncovering risks hidden in data

With the global proliferation of data over the past several years, legacy manual systems can’t keep up. That can mean that noncompliance and even corruption risks may be hidden. If financial irregularities go undetected, revenue that a country or region relies on for public services can be misappropriated.

For tax ministries to do their jobs confidently, they need a solution that is flexible, scalable, and customizable to their specific needs.

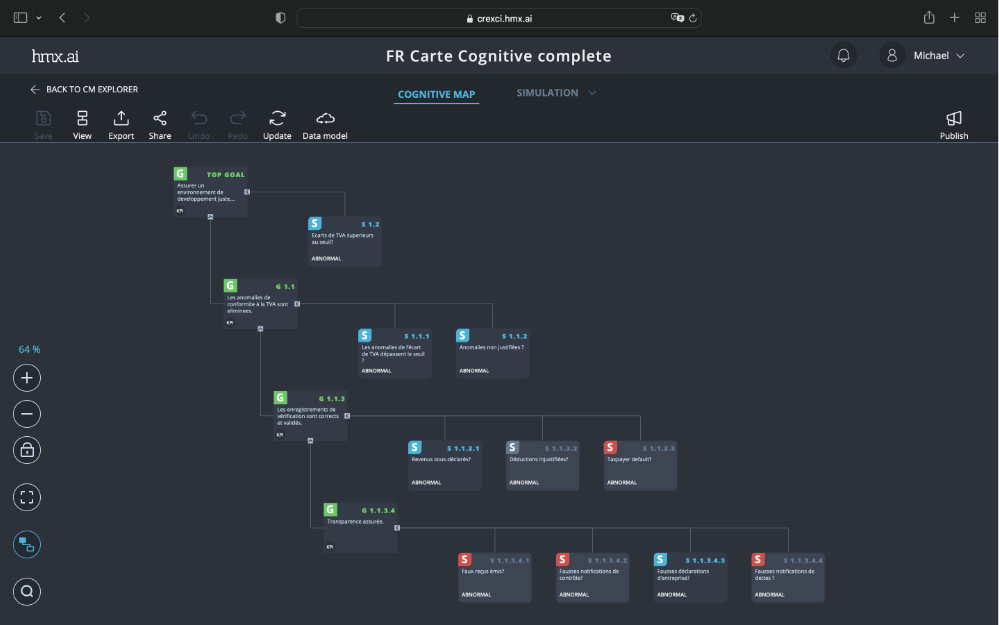

For over a decade, HMX.ai applied the Microsoft technology stack to build its government and industrial AI platform Cognitive Reasoning Engine (CRex). It utilizes Microsoft’s F# functional programming language for its core AI, Azure SQL, Azure Cognitive Services such as the new OpenAI large-scale AI models, and Power BI. CRex captures the skills and strategies of compliance experts and augments this knowledge with powerful, goal-directed, situational reasoning. KPIs, like income vs. debt, anticipated revenues vs. actuals, and collections of various types of tax like income tax or VAT, can be viewed on intuitive, actionable dashboards.

Pictured above: The HMX.ai Cognitive Reasoning Engine (CRex) dashboard, cognitive map.

The HMX.ai Governance and Compliance Intelligence System (GCIS) is used to achieve country-specific compliance, tax, and revenue goals. The government’s valuable institutional knowledge is captured in the GCIS cognitive module and then augmented by machine learning, enabling inspection of billions of pieces of data in near real time to detect situations that may warrant a closer look by staff in the country’s ministry. GCIS’s unique design ensures that technology always supports the achievement of government-specified goals.

One scenario, many possible explanations

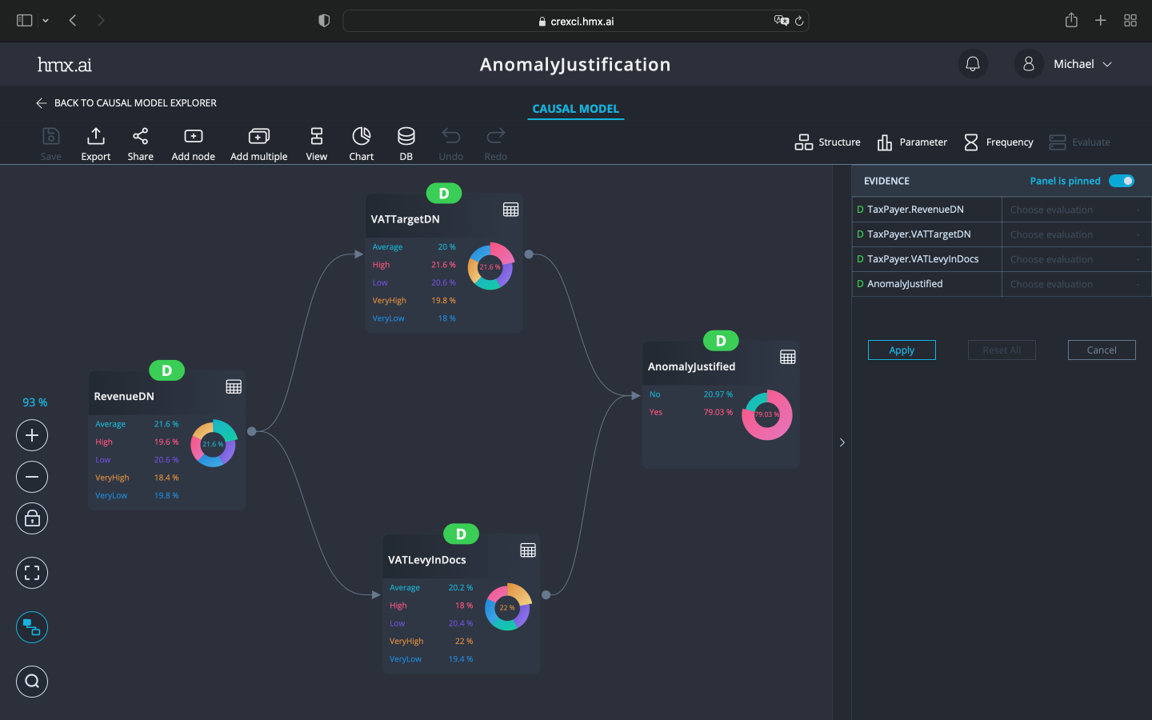

As an example, Barnett discusses a VAT tax gap scenario in the system dashboard. “There are several reasons that could cause this scenario,” he says. “A commercial entity may have had a tax bill that was incorrect, so the ministry needs to revisit that. Or the ministry may decide to do an audit of that company to look for underreported revenue, VAT manipulation, or unjustified deductions. Or perhaps a previous audit may itself need to be audited. In many cases, it’s missing data or an honest mistake.”

GCIS provides explanations for its findings with Explainable AI. It provides the employees and officials of the tax ministry who take the next steps with information to empower and support their assessments. Customized Power BI views for users according to their role in the tax ministry make this efficient and intuitive. Says Barnett, “An additional benefit of explainable AI is that unintended biases picked up by machine reasoning are exposed and corrected to ensure a fair compliance environment.”

Pictured above: The HMX.ai Cognitive Reasoning Engine (CRex) dashboard, causal model.

A true human-machine partnership

“Along with Microsoft, we talk a lot about digital transformations that partner knowledgeable experts with machine learning,” Mayyasi says. “Together, we advise governments to not walk away from their decades of valuable institutional knowledge, and instead, capture and accelerate it.”

The GCIS solution spans the entire Microsoft technology stack, especially Azure services, to “enable HMX.ai to complete a proof of concept for a government tax compliance solution within 30 days. If the government accepts that proof of concept, HMX.ai will help put the solution into production,” Mayyasi says.

He continues, “What’s delightful about compliance and governance is it’s an area that requires transparency and really lends itself to the partnership between human and machine in hugely important and valuable ways.”